Long-term care typically refers to support required for an individual to perform the regular activities of daily living, such as dressing and bathing, due to a medical or mental condition. According to data from the Department of Health and Human Services (DHHS), 70% of Americans today will require some type of long-term care, and the average person will pay roughly $138,000 for their long-term care.

Almost everyone will qualify for Medicare coverage, but Medicare does not cover long-term care for permanent physical or mental limitations. In those cases, the individual is responsible for payment using their own resources or long-term care insurance.

What Types of Long-Term Care Exist?

There are three types of long-term care. All three types can be provided at home or in a dedicated facility. The first and most-used type of long-term care is custodial care: daily, non-medical living activities like eating, dressing, bathing, or getting around town. One step up from custodial care is intermediate care: health care that is provided by a skilled professional at regular intervals but usually on an infrequent basis. The third type, called skilled care, involves 24-hour professional health care. Although many people associate skilled care with nursing homes, it may be provided at your own home, in an assisted living facility, in a hospital, or in other locations.

How Will You Pay for It?

Medicare provides healthcare benefits for medical needs, including a percentage of some types of intermediate care and skilled care. It does not cover custodial care even if a paid professional provides that care. Medicaid, which is often confused with Medicare, is a joint federal and state healthcare program open to people with limited income and assets. Medicaid covers some long-term care but provides only limited coverage, and because of the income limit, the majority of Americans do not qualify for this program. That means most people have two true options to fund their long-term care: pay out of pocket or buy long-term care insurance.

Is Self-Insurance a Good Option?

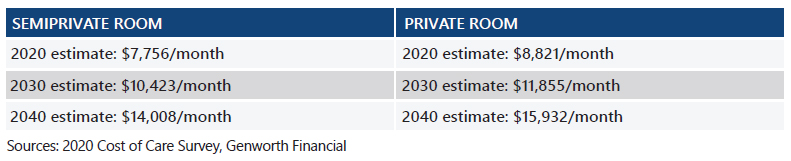

Paying out of pocket—also called self-insurance—is the most common way to pay for long-term care expenses. Self-insurance gives you the freedom and flexibility of full control over your long-term care decisions without having to consider what is covered or not covered by your insurance policy. When choosing this option, it’s important to understand the rising costs of long-term care and be sure you are making an intentional decision as part of your financial plan. If you choose to self-insure, you’ll want to be confident that you have sufficient assets to pay the costs of care, no matter what. You may need to reallocate liquid assets, and you may face corresponding tax consequences.

What is Long-Term Care Insurance?

Long-term care insurance (LTCI) is specifically designed to pay for long-term healthcare in settings like nursing homes or in your own home. Policies vary widely, so it is important to know what you want and choose a policy that aligns with your needs. Most policies cover all three levels of care so long as you are receiving them in a licensed nursing home. Some policies will limit or exclude additional settings, like home health care. Generally, LTCI will also cover adult day-care centers, respite care, and other forms of health care provided by licensed and registered professionals, like physical therapists and nurses. Comprehensive policies are more likely to cover home care services and assisted living, but also come with a heftier premium. Some comprehensive policies will cover the cost of personal care consultants and caregiver training for a family member or friend. Before you can use your benefits, insurance companies typically require that you meet certain physical, social, or mental conditions.

Talk with your financial advisor about your needs, concerns, and desires. Having a plan in place will help you evaluate potential scenarios, stress-test your choices, and feel confident in your long-term care decisions.